Owners’ equity, also known as shareholders’ equity, typically refers to anything that belongs to the owners of a business after any liabilities are accounted for. When a balance sheet is reviewed externally by someone interested in a company, it’s designed to give insight into what resources are available to a business and how they were financed. Based on this information, potential investors can decide whether it would be wise to invest in a company. Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, such as liquidity, profitability, and debt-to-equity ratio.

Accounting equation

Understanding how to use the formula is a crucial skill for accountants because it’s a quick way to check the accuracy of transaction records . The balance between assets, liability, and equity makes sense when applied to a more straightforward example, such as buying a car for $10,000. In this case, you might use a $5,000 loan (debt), and $5,000 cash (equity) to purchase it.

Which of these is most important for your financial advisor to have?

All programs require the completion of a brief online enrollment form before payment. If you are new to HBS Online, you will be required to set up an account before enrolling in the program of your choice. Balance sheets are typically prepared and distributed monthly or quarterly depending on the governing laws and company policies. Additionally, the balance sheet may be prepared according to GAAP or IFRS standards based on the region in which the company is located.

Do you own a business?

Additionally, you can use your cover letter to detail other experiences you have with the accounting equation. For example, you can talk about a time you balanced the books for a friend or family member’s small business. Think of liabilities as obligations — the company has an obligation to make payments on loans or mortgages or they risk damage to their credit and business. The double-entry practice ensures that the accounting equation always remains balanced, meaning that the left-side value of the equation will always match the right-side value.

The asset equals the sum to all assets, i.e., cash, accounts receivable, prepaid expense, and inventory, i.e., $305,483 for the year 2018. Balance sheets are one of the primary statements used to determine the net worth of a company and get a quick overview of it’s financial health. The ability to read and understand a balance sheet is a crucial skill for anyone what does productively mean involved in business, but it’s one that many people lack. Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. Additional paid-in capital or capital surplus represents the amount shareholders have invested in excess of the common or preferred stock accounts, which are based on par value rather than market price.

- Investors can get a sense of a company’s financial well-being by using a number of ratios that can be derived from a balance sheet, including the debt-to-equity ratio and the acid-test ratio, along with many others.

- This financial statement lists everything a company owns and all of its debt.

- Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense.

- For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper.

- Creditors have preferential rights over the assets of the business, and so it is appropriate to place liabilities before the capital or owner’s equity in the equation.

Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity. This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations. Other names used for this equation are balance sheet equation and fundamental or basic accounting equation. One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity). The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations.

The name “balance sheet” is based on the fact that assets will equal liabilities and shareholders’ equity every time. Taking time to learn the accounting equation and to recognise the dual aspect of every transaction will help you to understand the fundamentals of accounting. Whatever happens, the transaction will always result in the accounting equation balancing. A trade receivable (asset) will be recorded to represent Anushka’s right to receive $400 of cash from the customer in the future.

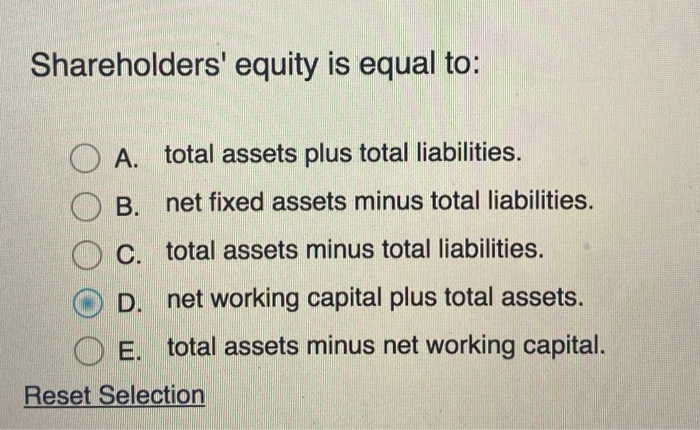

As a result of this transaction, an asset (i.e., cash) increases by $10,000 while another asset ( i.e., merchandise) decreases by $9,000 (the original cost). On the other side of the equation, a liability (i.e., accounts payable) is created. At this time, there is external equity or liability in Sam Enterprise. The only equity is Sam’s capital (i.e., owner’s equity amounting to $100,000). If we rearrange the Accounting Equation, Equity is equal to Assets minus Liabilities. The assets are the operational side of the company, basically a list of what the company owns.

Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf. If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information.

Shareholder equity is not directly related to a company’s market capitalization. The latter is based on the current price of a stock, while paid-in capital is the sum of the equity that has been purchased at any price. That’s because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity). A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health.

Our easy online enrollment form is free, and no special documentation is required. No, all of our programs are 100 percent online, and available to participants regardless of their location. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.