Earn rewards for learning

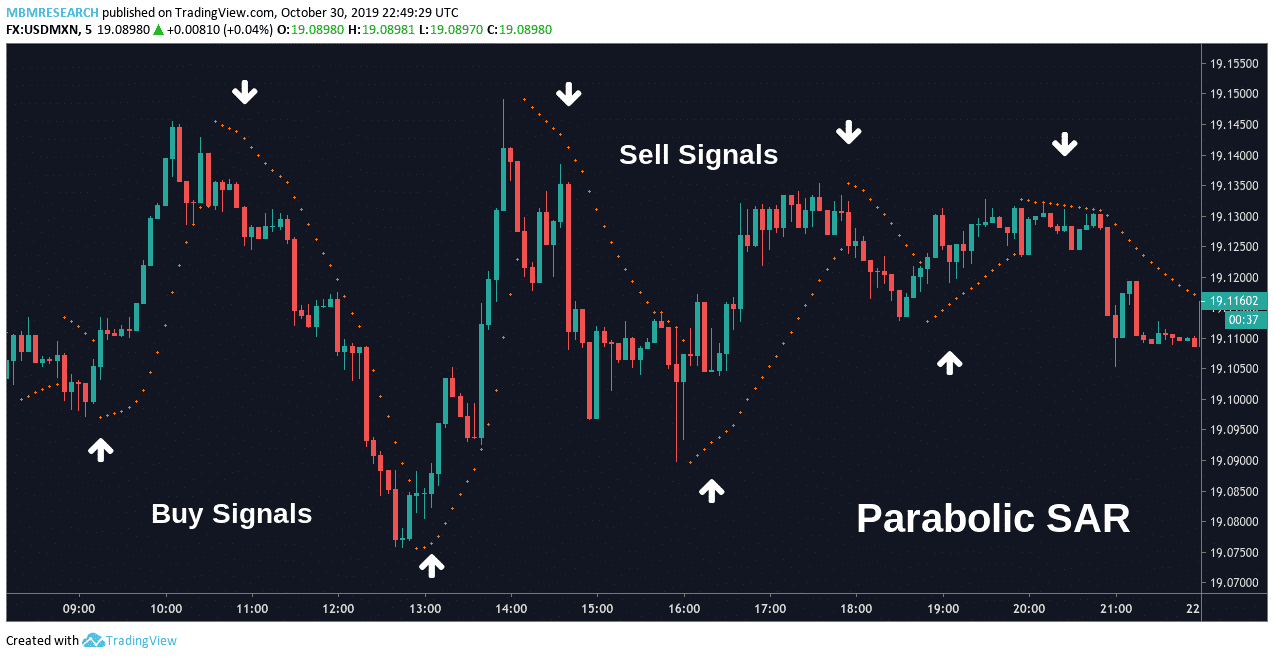

Insider trading is the trading of a company’s securities by individuals with access to confidential or material non public information about the company. Though rush hours offer opportunities, it’s safer for beginners to avoid them at first. Insider screener makes monitoring insider transactions easy. Global oil benchmark Brent crude climbed 0. Learn to spot signals, understand short squeezes, and boost your trading success. Range traders will also use tools, such as the Bollinger band or fractals indicators, to identify when the market price might break from this range – indicating it is time to close the position. Independence Day/Parsi New Year. Account Setup: To get started, users must create an account with the trading app. For a limited time only, get 3 Ledger Nano S Plus wallets for yourself and your loved ones with a 10% Ledger discount code. For even faster growth, users can use Acorns’ Round Ups Multiplier to multiply their savings. The most popular exponential moving averages are 12 and 26 day EMAs for short term averages, whereas the 50 and 200 day EMAs are used as long term trend indicators. It doesn’t matter if you’ve been trading for 3 years or 30 years, every person is susceptible to being influenced by emotions to some degree. Place an order with your broker, specifying the details of the contract, expiry month, contract size, and so on. Starting Cost: ₹5 15 lakhs to buy smart home devices, set up installation services, and for marketing. A trader tries to capitalise on such momentum by identifying the stocks that are either breaking out or will break out. Please be advised that our Client Portal is scheduled for essential maintenance this weekend from market close on Friday 5th April, 2024, and should be back up and running before markets open on Sunday 7th April, 2024. One Up On Wall Street’ was written by Peter Lynch, one of America’s most famous fund managers and investors. Scalping and swing trading are completely different; where scalping requires opening and closing multiple positions within a few seconds or minutes, swing trading involves opening fewer positions and only closing those positions after a few days or weeks. This feature allows for the frequency of transactions. Traders involved in day trading buy and sell stocks on the same day.

Screenshots

These apps allow users to trade in various financial markets and manage their investment portfolios using smartphones or tablets. Account would be open after all procedure relating to IPV and client due diligence is completed. 26% take fees for trades of $50,000 or less. A useful intraday tip is to keep track of the market trend by following intraday indicators. Choosing the right stockbroker for opening your trading account is a must for a good trading experience. This 1 candle bearish candlestick pattern is a reversal pattern, meaning that it’s used to find tops. Most investment platforms offer similar benefits. Here are the best brokers for beginners. Almost every candle has so called shadows or wicks. Traders technically analyse the stocks to gauge the movement patterns they are following for proper execution of their investment objectives. Search for the definition you are looking for. Splashes of adrenaline from fast trading is an important factor in your decision to make a living by scalping. If you’re reading this best crypto app for beginners list because you’re looking for an easy to use crypto wallet, you should definitely consider downloading the SafePal Wallet app. This is the book that started it all for me. Thank you for your enquiry. Margin Trading Facility MTF – The terms and conditions prescribed hereunder form part of account opening form, shall be read in conjunction with the rights and obligations as prescribed under SEBI circular no. There’s also a significant risk in selling options since you take on theoretically unlimited risk with profits limited to the premium price received for the option. In testing platforms and apps, our reviewers place actual trades for a variety of instruments.

Scan to download

To start trading on leverage, it is advisable that a trader starts with a leverage that is lower than their maximum leverage allowance. Registering a trademark gives you the right to take legal action against anyone who uses your name without permission. We want to clarify that https://www.pocketoption-exchange.today/ IG International does not have an official Line account at this time. Answer in one sentence only. Normally, to find the best app specifically for you, you would have to go through numerous crypto app reviews. Secrets of Pivot Boss – by Franklin O. More information about the insider regulations and insider trading can be found on the page Market abuse in Swedish. Both of those strategies are time decay plays. Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. Yes, if you are an Android user, you can easily download and use it for free. AlgoBulls AlgoBulls Technologies Private Limited does not guarantee the accuracy or completeness of any information provided on our platform, including third party content. With paper trading, a new trader can learn to manage the stress that is present in real stock trading. See a list of frequently compared brokers and compare more before choosing. Trade your own account. Measure advertising performance. Check if stock exchanges in India are open today. When you come across a system claiming to offer extraordinary returns, be skeptical.

Business Focused Features and Offerings

Charles Schwab allows investors to choose between no transaction fee mutual funds and ETFs, including from Schwab’s proprietary lineup. Thereafter, all that remains to be done is to create a trading plan and open a live account. Stocks are good investments for beginners if they can leave their money invested for at least five years. Yes, algorithmic trading can be very profitable. For call options, that means the cost associated with doing so in other words, the money to buy 100 shares of the underlying stock will be due at that time. While the two styles of analysis are oftentimes considered as opposing approaches, it makes financial sense to combine the two methods to give you a broad understanding of the markets to help you better gauge where your investment is heading. For example, a company’s revenues may grow on a steady basis, but its expenses might grow at a much faster rate. Women are looking for more autonomy, work life balance, and financial freedom—and they’re finding it on their own rather than waiting for the corporate world to change. That practice, called selling order flow, is thought by some to result in customers getting worse prices when they buy or sell investments. Technical analysts closely watch for these patterns to forecast periods of persistent selling and downside ahead. You can adapt your strategies as your trading skills, life circumstances, and economic conditions change. 646 1983 was a pivotal U. Unlike day trading’s frenetic pace, swing trading thrives on holding positions for a span spanning from a few days to several weeks, with the typical duration hovering around 2 3 days. However, any losses you make will be based on the full position size and could exceed your initial deposit – so, it’s important that you manage your risk properly. They serve different purposes and suit different profiles. Swing trading involves placing trades that can last from a couple of days to couple of months and turning a profit by anticipating the price difference. Did you try calling them to see what is taking so long to figure out your issue. Referral Bonus: Earn Rs. The size and type of “formation” are important: you should note if two rounding tops are building up and the size. IG offers an impressive suite of proprietary mobile apps, led by its flagship IG Trading app also known as IG Forex, which boasts a well designed layout teeming with features such as alerts, sentiment readings, and highly advanced charts. Interest on margin trading is typically added to the margin balance monthly. Scalping is a trading style where small price gaps created by the bid–ask spread are exploited by the speculator.

Ready to trade your edge?

The investment value can both increase and decrease and the investors may lose all their invested capital. Algo trading offers the following benefits for scalpers. A call option buyer has the right to buy assets at a lower price than the market when the stock’s price rises. Use limited data to select advertising. Some traders also use options for more general profit earning. Here’s how you can trade online. This includes no short shares being available as well. Grasp important trading concepts through deep analysis with both winning and losing examples. What are Futures/ Futures Contracts. However, with Quantum AI’s commitment to connecting users to educational resources, each person can hopefully overcome these complexities. Concepts explained in an easy to understand style. Bajaj Financial Securities Limited or any of its associates / group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Risk and return are measured as well as portfolio impacts of trades and tax implications. Let’s look at an example of where you could enter a bullish double bottom pattern in this chart of PLTR recently.

Book review

Bigger Instant Deposits are only available if your Instant Deposits status is in good standing. You will get many features in it, like earning money by playing games or by referring this app to your friend. That said, when there’s a downtrend, traders enter short positions or sell their shares. Because it involves purchasing two at the money options, it is more expensive than some other strategies. This intraday trading strategy involves finding the stocks that have broken out of the territory in which they usually trade. You can use a paper trading simulator to help build confidence in your strategy. They service traders all over the world. We will be happy to resolve any of your inquiries. To set up a managed account, you must do so through Schwab. Please see our General Disclaimers for more information. As a general rule of thumb, you would factor in double the potential profit amount if not more you expect to make versus the amount you stand to lose if the price moves in an unexpected direction. Contracts for difference CFDs are a way of speculating on the change in value of a foreign exchange rate. This maximizes the student’s chances of finding a class that aligns with their goals, schedule, and budget. This trading style is mainly done through derivative products such as CFDs or spread betting, allowing them to open positions on rising and falling markets. This mailer and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services. It’s also a rare glimpse into the everyday life of a bonafide Wall Street legend. Full price of shares required. The scandal led regulators to ramp up scrutiny in the area. The best day trading platforms that made our list provide excellent apps for analyzing indicators and executing trades on a variety of securities including stocks, cryptocurrency, options, forex, futures, and more. Side hustles for better or worse are less committing than full time ventures. On BlackBull Market’s secure website. Tick charts can be used for scalping and also keep out of money trades that need correction. 1 – Day Trading: The Basics And How To Get Started – Investopedia. To become a seasoned trader, you need to have hours of “screen time” with a real account to get familiar with this sensation of that adrenaline high. Ally credit cards are issued by Ally Bank, Member FDIC.

You can trade rising and falling prices

When you have free trades, you have to realize that these investment companies are making their money one way or another. If a trader does not end up closing out their position by the end of the trading day, their broker may do so for them. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. But it’s also important to keep in mind some caveats. Apart from high volatility, scalpers also look at financial instruments that have a high trading volume and a high level of liquidity because they enter and exit positions much faster than other styles of trading; they are also looking to get in and out at the best possible price to try and secure any potential profits earned. Best intraday stocks tend to possess medium to high volatility in price fluctuations. Tax laws are subject to change, either prospectively or retroactively. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Based on our hands on analysis, we’ve identified the 9 best options tailored to various trading needs. Investopedia / Madelyn Goodnight. Contact us by phone, email or Twitter. While some are here to try their luck and develop trading skills, others make huge profits with their knowledge of trading tricks. They are commonly used by MNCs to hedge their currency positions. That is why we evaluate how well these forex brokers perform for you, including how trustworthy they are, what support they provide, and how the value they provide balances against the costs. SoFi’s app is less robust than some larger competitors, which makes it easy to navigate and understand if you don’t have as much market experience. Undoubtedly a very helpful software for a novice like myself, with a user friendly interface and fantastic functions, as well as constant notifications even when I’m not using the app. By learning from the experiences of legendary traders, individuals can gain valuable insights into effective strategies and mindsets that can enhance their market success. These apps offer users an easy and convenient way to manage their investments, track their portfolio performance and make informed investment decisions. 75 or a buy stop at 2950. Stock Market Trading Holidays. In an active market, these stocks will have a high transaction volume. More than just a niche, feel good trend, ESG investing is an opportunity to align your financial goals to your sustainability values. Wondering What’s The Ideal Age To Start Investing In Mutual Funds. “Margin Rules for Day Trading. The primary objective is to “scalp” or capture small price differentials, accumulating profits over a high frequency of trades. Another key distinguishing feature of Public is its transparent revenue sharing. If you don’t have any Bitcoin to hand, you will first need to buy some and then transfer it over to your Deribit account. Well, there are many points one can consider based on their own preferences. TradeSanta is an automated trading platform that provides a wide range of tools to set up trading bots. As an Amazon Associate, investor.

The Bankrate promise

If the M pattern aligns with the completion of wave B in Elliott Wave Theory, and there’s a confirmed break below the neckline, it strengthens the bearish case. With CFDs, you can also get exposure to various markets via listed futures and options. If you are thinking about day trading, I urge you to think again. Thanasi Panagiotakopoulos, CEPA, MSF, BFA. For example, you could measure the maximum historical drawdown of the strategy, and decide to stop trading it once it goes into a drawdown that is x times deeper. Our Super App is apowerhouse of cutting edge tools such as basket orders, GTT orders,SmartAPI, advanced charts and others that help you navigate capitalmarkets like a pro. A break above the resistance line suggests a bullish continuation, while a break below the support line indicates a bearish reversal. Maybe this will just get better with more experience.

How is Trading False Breakouts Using Protective Stops?

A demo of ETRADE Mobile, the broker’s more beginner friendly mobile app. Open source provides you the freedom to modify it to suit your needs. Use statistical measures like the Bollinger Bands to find overbought or oversold conditions. More often than not, trading apps feature resources like live news streams, interviews, market analyses, and more to keep traders up to date about the market, which enriches their research greatly. If the stock’s price dropped and the option contract expired, you’d still be out the premium cost of $3 per share. Understand what this investment strategy is and how to start. The special session will test the preparedness of the exchanges in case of any unexpected event during a normal trading session. Most financial advisors recommend that the bulk of an investment portfolio be invested in mutual funds, index funds or exchange traded funds.

FOR MEMBERS

A stochastic oscillator is. Holders of an American option can exercise at any point up to the expiry date whereas holders of European options can only exercise on the day of expiry. Submit any one photo identity proof like a PAN card / Voter’s ID / Passport / Driving license / Aadhaar card. Trusted market leader – Exness brokers are licensed by FSA, CySEC, FCA, FSCA, FSC, FCS, CMA. You have successfully subscribed to Blueberry Jam. Privacy Policies and Procedures Terms and Conditions Referral T and C Anti Money Laundering Policy RMS Policy Security Research Disclaimer Copyright Important Links Disclaimer Careers KYC document in vernacular languages Stay Secure Stay Alert NDNCR Terms and Conditions Filing complaints on SCORES Easy and quick ATTENTION – A note from the Regulators for Investors KYCTrading + DP account AMLCFT Investor Education SEBI Investor Charters BSE Investor Grievances Contact Us Complaints Disclosure Bank A/c Disclosure Risk Disclosures on Derivativess Investor Service Centres Online Dispute Resolution Link Sharekhan Branch Details Authorized Persons Details Key Managerial Personnel Filing Complaints at Sharekhan Account Opening Flow at Sharekhan Investor Risk Reduction Access IRRA Investor Demise: SOP on Reporting Norms SEBI Investor Website Procedure for Voluntary Freezing of Online Access to Trading A/c Client Collateral Details. With Bajaj Broking, brokerages go as low as ₹10 per order flat for all segments of trading: Intraday, Futures and Options, and Delivery. To learn more about how Bankrate reviews brokers and robo advisors, check out our methodology page. They have 20+ years of trading experience and share their insights here. Com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. A moving average smooths price data by calculating the average of closing prices over a set period, aiding in trend identification. You go up to the counter and notice a screen displaying different exchange rates for different currencies.

Milan Cutkovic

Com uses a variety of computing devices to evaluate trading platforms. Best In Class for Offering of Investments. Plus500 products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, ASX or their affiliates and none makes any representation about investing in such products or has any liability for any errors, omissions, or interruptions of the indices. The best part about this book is the author has tried to include answers to all the general questions. HFT: These strategies use sophisticated algorithms to exploit small or short term market inefficiencies. It occurs when a bearish candle is followed by a bullish candle that opens above the previous candle’s price. According to the study by the research team at the Technical Analysis of STOCK TRENDS TAST project, published in their comprehensive market analysis report, the piercing line pattern has a success rate of approximately 60% in predicting bullish reversals. By implementing a stop loss order to your position, you can limit your losses if your chosen market moves in an unfavourable direction. $0 stock and ETF trades. While those options make it possible to buy stocks online without a broker, on their own they are not effective ways to build a diversified portfolio of investments that is right for long term investing. For example, charting on the mobile version of the Next Generation platform is just as impressive as the web version. Let’s explore the differences. There’s also an appendix that outlines how traders can build, test and evaluate a trading system. This is similar to a workplace pension, which is what your employer would have set up for you if you are employed. The following index products are excluded from the capped commissions offer: SPX, RUT, VIX, OEX, XEO, DJX, and XSP. Research and Analysis. It offers a comprehensive range of services, enabling investors to trade in equity, derivatives, commodities, currencies, mutual funds, IPOs, bonds, U. Alternatively, should there have been low volume, the price action may not be as convincing as not many investors are choosing to invest at the current pricing levels. The Bearish Engulfing pattern consists of two candles: the first is a smaller bullish candle, and the second is a larger bearish candle that completely engulfs the body of the first candle.

Share this template

There are mainly two types of options. Founded in 1790, The NASDAQ OMX PHLX, also known as the Philadelphia Stock Exchange is an options and futures exchange located in Philadelphia, Pennsylvania. Set alerts based on one or multiple conditions, in one or multiple time frames. This is usually reserved for traders who work for larger institutions or those who manage large amounts of money. Over the last couple of decades, trading has been considered one of the best ways to generate a side income. Contrary to bullish candlesticks, bearish candlestick patterns are just what you would assume. SEBI study dated January 25, 2023 on “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options FandO Segment”, wherein Aggregate Level findings are based on annual Profit/Loss incurred by individual traders in equity FandO during FY 2021 22. At Sarwa Trade, you can buy and sell stocks and ETFs at 0. It really doesn’t matter which yours is, so long as you have good execution. Subscribe to Research. I’m happy to share a positive review of Bybit, the cryptocurrency exchange. Traders who engage in these strategies must have a solid understanding of market trends, technical analysis, and risk management techniques to succeed. It’s important to read the details on your chosen trading platform to ensure you understand the level at which price movements will be measured before you place a trade. That is why, if you want to work in this trading style, you need to develop a robot and try to locate it as close to the exchange as possible. Trading 212 is a great option for demo accounts, letting you practice trades with virtual money before committing real funds. However, while these timeframes are popular for their fast paced nature, they can also introduce more market noise and less reliable signals compared to longer timeframes. This rule applies to DMing fellow members as well. It is done through dabbawalas who act as brokers in the dabba market.