Content

Of numerous checks, particularly the quicker individual checks, provides a published line “Do not produce, stamp, otherwise signal below it range.” Normally, this is in the 1.5 inches in the left end of one’s straight back of your look at. I reserve the ability to enforce limitations on the money count(s) and/or amount of products that your shown using Cellular Put and you will to modify for example limitations inside our only discretion. Restrictions would be influenced by the financial dating plus each day restrict usually screen inside Cellular Software. If you try to begin a deposit more than these limits, we could possibly refuse your own put.

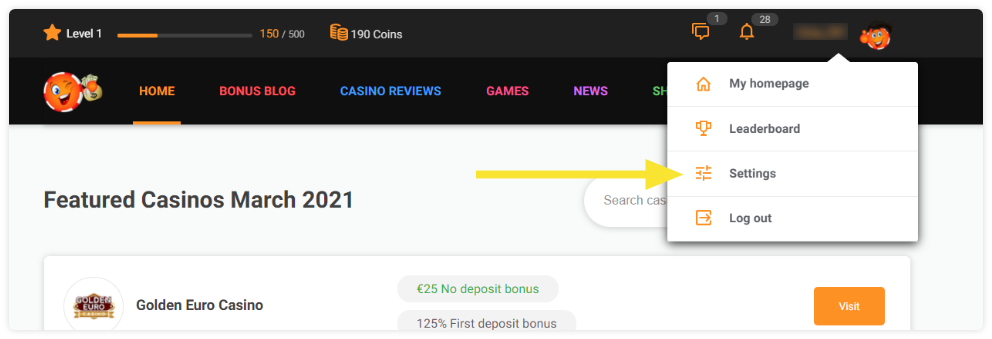

Common Kind of Pay from the Mobile phone Local casino

3Send Currency that have Zelle can be acquired for most individual checking and cash market profile. To make use of Posting Currency that have Zelle you’ll want an internet Financial profile having a great U.S. target, an alternative You.S. cell phone number, an energetic unique elizabeth-post address, and a personal Shelter Number. Their eligible individual put account should be effective and you can let to have ACH transactions and online Banking transfers. To transmit money to own birth one to arrives typically within seconds, an excellent TD Bank Visa Debit Cards is needed. Message and analysis prices get implement, consult your cordless supplier.

Shell out From the Cell phone Ports

We’re paid in exchange for keeping paid products and functions, otherwise from you clicking on particular hyperlinks published to your our web site. Even as we make an effort to render a variety of now offers, Bankrate doesn’t come with information about the financial otherwise borrowing from the bank tool or solution. From the Santander Lender, including, there’s a regular mobile put limitation out of $dos,five hundred for people which’ve got a make up at the very least 3 months.

Venmo Costs to own 2024: All you have to Discover

The newest Cheque Clearing for the twenty-first Century Work lets banks to help you https://vogueplay.com/uk/wild-spirit/ accept alternative mobile deposit cheques if they’re the newest judge exact carbon copy of an actual physical cheque. That’s what secluded put bring allows—the new replacing of an electronic kind of your own cheque for a paper you to definitely. You ought to discover some type of see, either through your smart phone or via email, that your particular mobile deposit deal is accepted. Even if still have up until their month-to-month cell phone expenses arrives to shell out the dough, the cash might possibly be available for gamble immediately.

The conventional way of cashing inside cheques by going to a department, Postoffice otherwise through the article will stay available when it technologies are perhaps not right for people. To test the new status away from cheques placed via the software, excite click on the account the brand new cheque are placed in order to and you will click ‘My Transactions’ where their intricate equilibrium data is shown. Any cheques not even cleaned would be revealed while the a good pending purchase. If you’ll find one difficulties with cheques you have paid-in, we’ll get in touch with your. Please take care of the cheque until the money is obtainable in the account.

- Of several banking institutions and you can borrowing from the bank unions supply the ability to use your phone’s camera and you may a secure software to store a visit to the fresh part.

- Remain to come having automatic expertise on your using patterns, payments coming due, and you will strange activity.

- To begin, phone call one of many playing banking companies or borrowing from the bank unions noted on the brand new VBBP webpages.

- There are some reasons why you should consider depositing via cellular telephone bill.

- Scam try a significant criminal offence that is punishable because of the an excellent jail phrase.

- Pursue QuickDeposit℠ can be obtained for come across mobile phones.

Cellular deposit is among the ways in which financial is definitely evolving. Utilizing your financial’s cellular app and your cellular telephone’s cam, you could potentially put a to your account rapidly, any time you want. If or not you’re hectic juggling existence, on the go to your second concert or perhaps standing on the chair on your PJs, cellular put makes it possible to receive money yourself conditions.

Spend from the mobile is one of of a lot financial alternatives, and all sorts of transactions is actually canned easily and you may securely. However, never play with a mobile banking application to your an unbarred Wi-Fi circle (in fact, never ever accessibility one painful and sensitive accounts more than personal Wi-Fi). And if you’re likely to play with such as an app, make sure you safe the cellular telephone with a great passcodea additional one regarding the code make use of in order to log in to the brand new banking app.

There’s no additional fee for making use of Mobile Look at Put but we recommend that you speak to your provider to see if the you can find one cordless company costs. “Checks must be recommended just as they will when the you were deposit them in the-individual at the financial,” claims Bonnie Maize, an economic coach during the Maize Financial in the Rossville, Kansas. Unlock a family savings or unlock a certification from Put (see interest rates) and start protecting your money. Capture pictures of the front and back of your own supported eligible take a look at using the application.

Secure the check in a safe place until the fund has cleaned on the account. Exactly like a bank statement, you’ll want to throw away the new take a look at properly just after time has passed. It is not a simple task to check out a neighborhood part to deposit a determine if you happen to be forced to own time. In some instances, you may need to enter individual put it, if you don’t mail it to your a lender handling heart. Therefore they’s a smart idea to hold onto the fresh look at before the deposit encounters.

If you try so you can begin a deposit more than these limitations, we could possibly deny their deposit. When we enable you to create in initial deposit in excess of this type of restrictions, for example deposit are still at the mercy of the brand new terms of it Arrangement, and we will not obligated to enable it to be such in initial deposit during the some days. Wells Fargo suggests storing a hard duplicate of one’s seek out five days. It can be tempting so you can toss the brand new look at directly into the newest shredder, but which could trigger troubles should your bank features an excellent concern in regards to the deposit. It might take a short time for the deal to be finalized, and that “might be a shock for young adults who’re accustomed to economic deals dealing with instantaneously,” Maize says.

Bankrate provides partnerships with issuers along with, yet not restricted to, American Express, Bank out of The usa, Financing One to, Chase, Citi and discover. We are a separate, advertising-offered analysis service. Ensure that the number registered suits the total amount on your view, and choose Done.

Although not, the three-7 payment time for the new debit cards was a disadvantage for many pages, because of the step 1% commission otherwise up to £3 per detachment, whatever the means. People during the KingCasinoBonus.british checked the newest gambling enterprise with a minimum of £5 which have Visa, Charge card, and you may PaybyPhone. But really, the site lacks well-understood e-wallets for example Neosurf otherwise Apple Pay. As soon as we make reference to the above mentioned readily available commission actions such as Charge, we could declare that the fresh deposit go out is quick, reliable and you can secure. However, you should know you do not start cashouts through PaybyPhone.