11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

FAR CPA Practice Questions: Journal Entries for Treasury Stock Transactions

- Double entry system of bookkeeping says that every transaction affects two accounts.

- In other words, this journal is used to record all cash that comes into the business.

- That is why the general journal is divided up into smaller journals like the sales journal, cash receipts journal, and purchases journal.

- Credit sales are transactions where the goods are sold and payment is received at a later date.

- At the end of each accounting period (usually monthly), the cash receipts journal column totals are used to update the general ledger accounts.

There is a proper procedure for recording each financial transaction in this system, called as accounting process.The process starts from journal followed by ledger, trial balance, and final accounts. Subsequently on a regular (usually daily) basis, the line items in the cash journal are used to update the subsidiary ledgers. Generally most cash receipts are from credit sale customers, and the subsidiary ledger updated is the accounts receivable ledger. As can be seen in the above example, 550 is posted to the ledger account of customer A and 350 to customer C. When posting to the accounts receivable ledger, a reference to the relevant page of the receipts journal would be included. All cash received by a business should be reported in the accounting records.

Cash and Discount Columns

In the cash receipts diary, all funds received from clients that fall under cash sales for goods and services are noted along with the counterparty’s name in the narration. The accounts receivable vs payable: differences and definition 2023 can be subdivided into different sections as well. For example, many companies want to know and evaluate the amount of cash they collected from sales, credit customers, and other sources. The other side of the three column cash ledger would be headed ‘Credit’ and show an identical format with the three columns representing the monetary amounts of the cash payment, bank payment, and discounts received. The other side of the two column cashbook ledger would be headed ‘Credit’ and show an identical format with the two columns representing the monetary amount of the cash payment and the monetary amount of the discount received.

Types of Cash Book

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Ask a question about your financial situation providing as much detail as possible. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. If desired, the area for the name of the account in this column can be replaced with an area for account numbers.

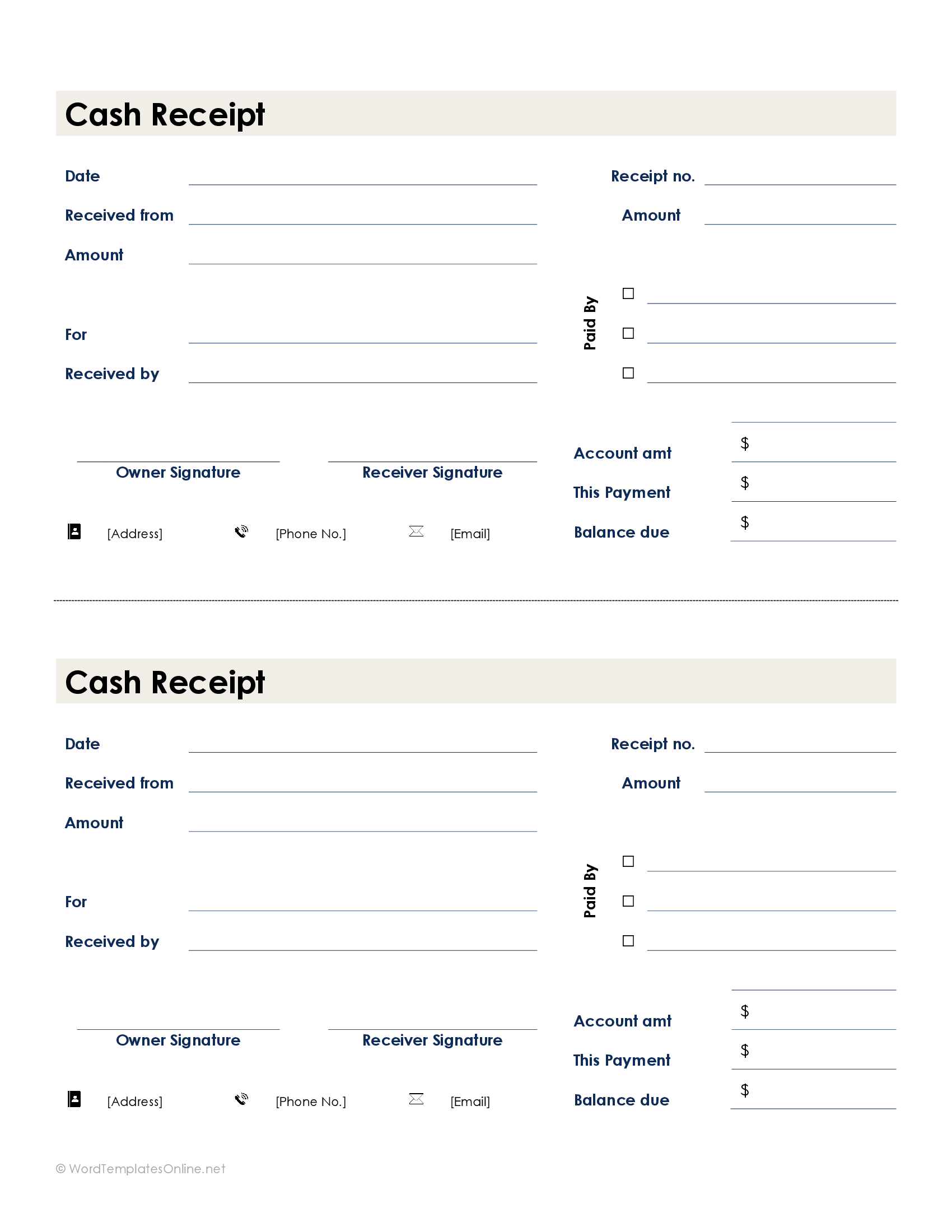

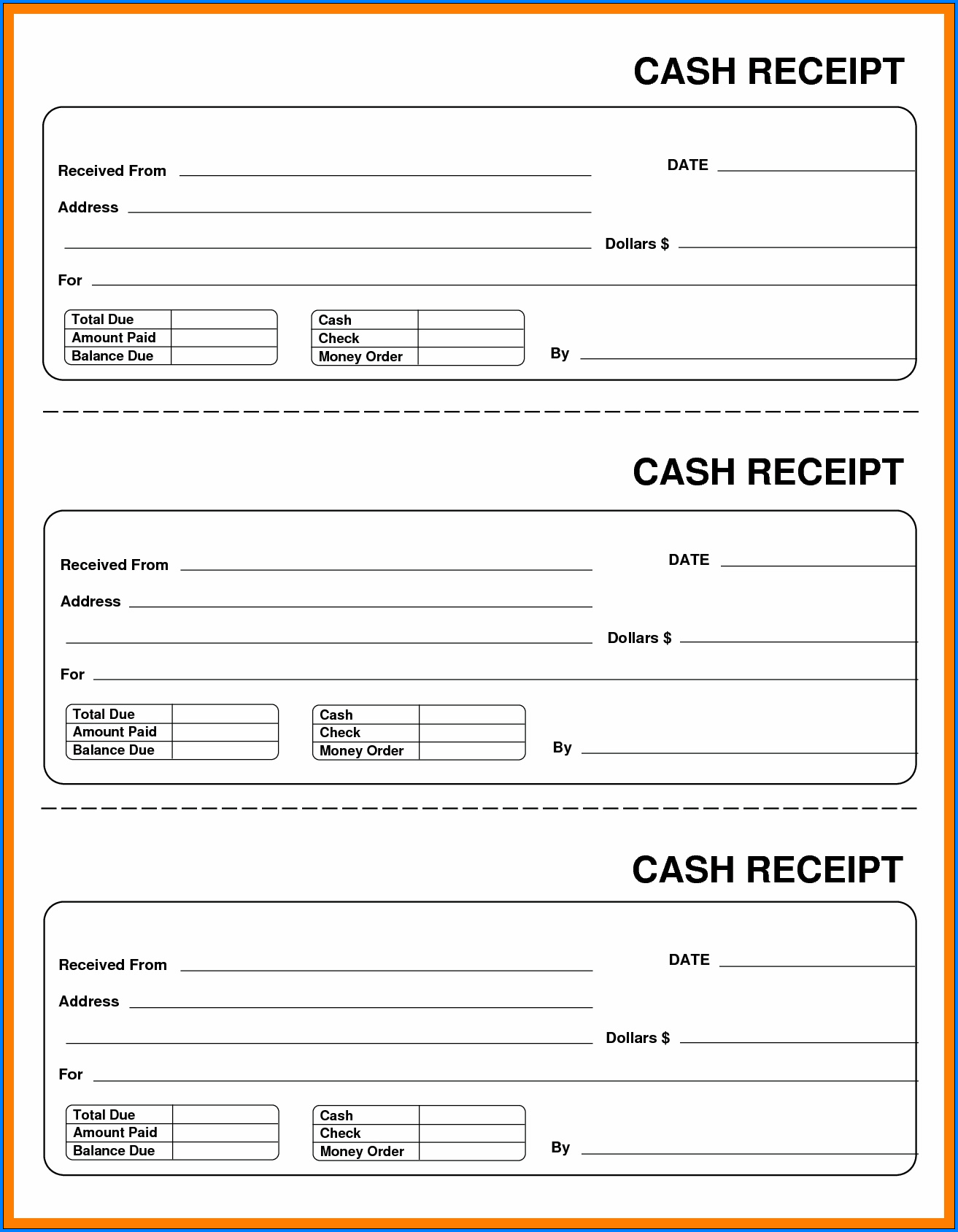

Cash receipts, on the other hand, serve as documentation of a cash sale from the cash received for your company. The cash receipts journal would cover items like payments made by customers on an unpaid accounts receivable account or cash sales. Whereas the cash disbursement record would include items like payments made to vendors to lower accounts payable. The cash receipts journal is typically totaled and summarized periodically (e.g., monthly) to update the general ledger accounts. The journal provides a convenient way to monitor and analyze cash inflows, helping businesses maintain accurate financial records, identify trends, and assess their cash management practices. Most often these sales are made up of inventory sales or other merchandise sales.

It doesn’t consider the accrual basis of accounting which is the principal basis of doing double-entry bookkeeping and prudent accounting. The following example illustrates how a cash receipts journal is written and how entries from there are posted to relevant subsidiary and general ledger accounts. The cash receipts journal manages all cash inflows of a business organization. In other words, this journal is used to record all cash that comes into the business. For recording all cash outflows, another journal known as the cash disbursements journal or cash payments journal is used.

You allow those customers to keep a running tab, and they pay you once a month. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

You may sell items or provide services that people pay for with cash, which may range from food or books to massages or even a ride in a taxicab. SequentiallyAccount-wiseDebit and CreditColumnsSidesNarrationMustNot necessary.BalancingNeed not to be balanced.Must be balanced. Since the cost of sales is essentially the cost of doing business, it is recorded as a business expense on the income statement. Record your cash sales in your sales journal as a credit and in your cash receipts journal as a debit. Keep in mind that your entries will vary if you offer store credit or if customers use a combination of payment methods (e.g., part cash and credit). All cash transactions made during an accounting period are documented in a cash receipts journal, which is set up as a subsidiary of the general ledger.

Cash sales, on the other hand on a cash basis of accounting and therefore are recorded in the cash journal. Another Loan taken by an individual from any bank or financial institution is also recorded in the cash receipts journal. The cash receipts journal is a special journal used to record the receipt of cash by a business.

As with other journals, the cash receipts journal is posted in two stages. Any entries in the accounts receivable column should be posted to the subsidiary accounts receivable ledger on a daily basis. A cash receipts journal is a special journal within the general journal that is used specifically to record all the cash receipts.

For example, the cash sale on June 1 is recorded in the cash receipts journal by first entering June 1 in the date column. The amount of $506 is then placed in both the cash debit column and the sales credit column. You record cash receipts when your business receives cash from an external source, such as a customer, investor, or bank. And when you collect money from a customer, you need to record the transaction and reflect the sale on your balance sheet. When you collect money from a customer, the cash increases (debits) your balance sheet.